Google Wallet vs. PayPal: Which one suits you best?

The shift from traditional to digital has come not just for businesses, but for individuals too.

With all of our key indicators shifting online, our mode of financial transactions today is also majorly via online platforms.

The two biggest contributors to the online payment process currently are PayPal and Google Wallet.

We will look at what these services offer, how they fare against each other based on crucial parameters and which one fits into your requirement of usage the best in a Google Wallet vs. PayPal scenario.

PayPal was founded in 1998, and has remained the most commonly used method of online payments for almost two decades.

It allows the user the option to choose whether he wants to directly connect his PayPal account to a bank account or not.

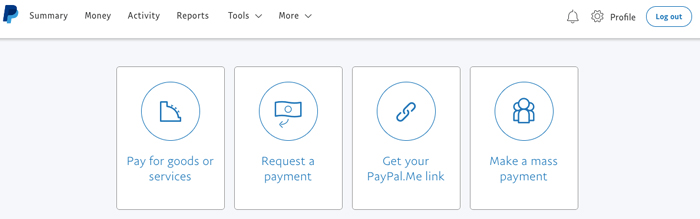

PayPal’s recent redesigns have made the interface easily accessible, and its use of shareable links has made money transfers a lot easier.

Google Wallet came about much later in comparison, with its initial release in 2011.

Although Google has come up with and pushed Android Pay recently, Google Wallet offered features almost exactly similar to PayPal, if not a notch better.

It is the tech giant’s attempt to take up a majority in the online transaction market share.

We will compare Google Wallet vs. PayPal for different important features to determine their strengths and weaknesses.

Accessibility

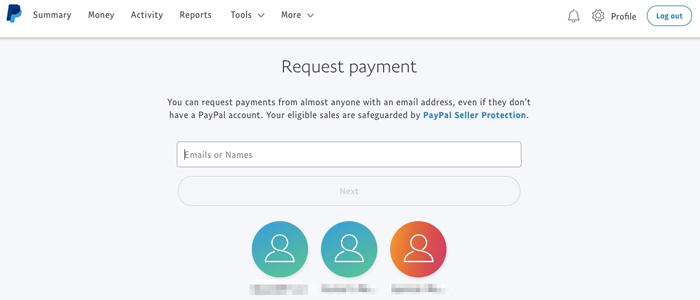

PayPal’s interactive interface makes it very simple for a user to log in and perform a transaction.

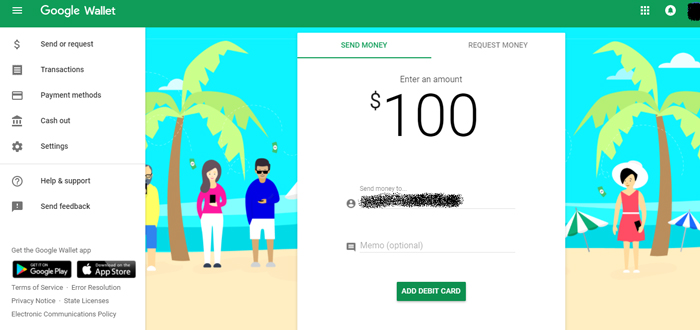

However, Google takes this a step further - you never even have to close your mails to send cash via Google Wallet.

Simple attaching an amount with the new message sends the amount to that recipient. You can complete the transaction via the Google Wallet app as well, though.

It is difficult to pick a winner between PayPal vs. Google Wallet in terms of their Android apps alone, although.

Google has the tools to offer better integration with Android. Simplicity is greater with the Google Wallet than with PayPal.

Processing Charges

Google Wallet transactions are free if you have a bank account that is linked to your Google Wallet ID.

Similarly, PayPal also offers free transactions when using a bank account.

For credit and debit cards, both Google Wallet and PayPal charge a processing fee of 2.9%, with a minimum cap on $0.30.

Both services offer the same processing charges, making it impossible to pick a winner here.

Security

In any comparison for online applications, security is a key factor. The comparison of Google Wallet vs. PayPal is no exception.

PayPal has been around for longer; therefore the security breaches reported on PayPal are also more than that of Google Wallet.

Both services claim to use robust encryption systems that keep your data safe and private. PayPal is a secure service to use.

Google services have proven their worth over a number of platforms for a number of years. And that is why perhaps the security assurance of Google Wallet ranks above PayPal’s.

Refunds

PayPal, by virtue of being the most commonly used platform, has well connected itself with the most frequently used online stores such as EBay.

If we are talking of a Google Wallet vs. PayPal scenario, PayPal would be the more likely option to get refunds as far as e-commerce is concerned.

However, Google Wallet gives a 180 day limit for claiming refunds. This is significantly more than PayPal’s 60 day limit for refunds on authorized charges.

Overall, the nature of requirement shapes which of these two services provides a better deal in terms of refunds or disputes over authorization of payment.

Coverage

PayPal enjoys a significantly larger user base than Google Wallet, and a majority hold of the market share.

For this reason, more people simply have PayPal than they do with Google Wallet, which makes transactions over PayPal an easier option for common payments.

Gmail remains the most common email service by far, but Google Wallet has not achieved the same level of popularity yet.

However, Google Wallet is a relatively new service and it is expected to grow in demand and usage as new features are added.

In terms of geographical reach as well, Google Wallet is being rolled out slowly.

This means that Paypal covers places that Google Wallet covered by PayPal that are not covered by yet.

However, this is expected to change with subsequent versions of Google’s app being released.

Withdrawal Speeds

PayPal completes its transactions within a maximum of 5 working days. Most transfers are completed within the first 3 or 4 business days of transaction.

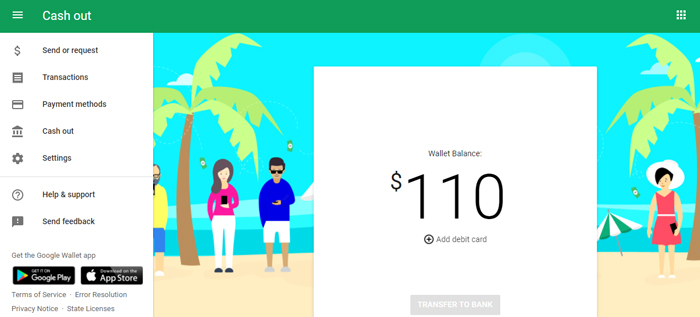

Google Wallet improves on this speed with its policy of completing all payments and transfers within 3 working days from initiation.

With greater withdrawal speed, Google Wallet offers a better option for fast transfers than PayPal.

Transfer Limits

The one-time transfer limit using a PayPal account is $10,000, and that of a Google Wallet account is $9,999, leaving very little to distinguish these two on that regard.

Both of these applications offer transfer limits far better than their nearest competitors.

However, with the other popular platforms capping their maximum amounts in the region of $2500 to $3000.

The criteria mentioned above are some of the key indicators when deciding on an online money transfer portal.

There is no decisive winner in the Google Wallet vs. PayPal just - what you need the app for determines which app is more suited to your purposes.

If you are looking for an all-in-one service, and if the majority of your transactions are from e-commerce sites such as the ones for online shopping, then PayPal offers you more functionalities in terms of possibility of refunds, good geographical coverage, etc. at almost the same rates.

However, if you are an avid Android and Google services user, you would find Google Wallet easier to navigate and its features more intrinsic to your requirements, which makes it the right choice for you to adopt.

Both these services have their strongholds, provide excellent security of data and reliable transfers, and are easy to access.

Which one you choose depends on your personal preferences, but it is hard to go wrong with either PayPal or Google Wallet.